Bitcoin Mining - Not A Waste Of Electricity

Consumption of electricity on Bitcoin is expected to burst forth in rivalry with Denmark nation on 2020. On some point, no matter what will be the chart's frequency on electricity, it is always Bitcoin that uses better in terms of energy.

- Overview - Table of Contents

- Two Groups Opposing Bitcoin

- Bitcoin Power Usage Is Not A Waste

- Bitcoin Is Clever

- Mining Is Promising And Profitable

- Bitcoin Prevents Inflation

- Bitcoin Ultimate Versus Fiat System

- ining Generates Heat

- Bitcoin Mining Supports IoT

- Struggles of Germany And Denmark In Excess Of Power

- Bitcoin Is Not Just All About Mining

- Constant Increase Of Mining Efficiency

In accordance with the level of industry, Bitcoin can be considered as the use of energy power that has a direct conversion to money.

Two Groups Opposing Bitcoin

1. The Eco-conscious

These group were seeking in general to reduce power consumption globally. Considering that electricity nowadays were generated with unstable methods, these eco-activist were trying to tell the world on conservation methods and general way on making electrical weigh more lighter. The campaign will be part of climate change control.

2. Skeptical Economists

These people were the ones who have doubt with Bitcoin. This group were being described by Paul Krugman as the one who argues that Bitcoin don't have value in the community and would just waste resources and labour including gold and etc.

Bitcoin Power Usage Is Not A Waste

It is such an easy way to defend Bitcoin from these group of people. You just have to point them to Bitcoin market as well as Bitcoin's existence and the explaination on why Bitcoin requires more energy to econ-concious in a good manner and everything is in place as soon as they are willing to listen.

Knowing about the power pressure socially, it is time to balance also the Bitcoin technology in terms of maintaining equally with nature.

All things considered, until advances in environmentally friendly power vitality decrease or invalidate Bitcoin's draw on naturally exorbitant vitality sources, Bitcoiners must attempt to guard the consumption by passing on the significance of this progressive distributed cash!

Here are 9 great reasons which, taken together and as we would like to think, totally legitimize the world's as a matter of fact high consumption of power on the Bitcoin extend:

1. Bitcoin Is Clever

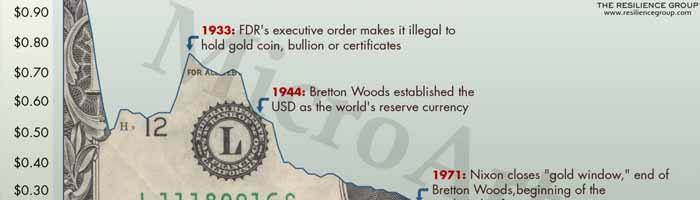

History repeats itself showing the prosperity to be depending on sound money, and it has been all over the millennia. Both the inflation on supply of fiat currency in modern central banks or coinage of Roman empire.

The final product of cash corruption is, sadly and constantly, monetary emergency. Mr. Mike Maloney's eminent arrangement, "The Hidden Secrets of Money," completely investigates this immortal authentic lesson in Episode 5.

Basically, cash with no sponsorship yet confidence in its controllers has a tendency to be fleeting and ruinous in its hyper-inflationary final breaths.

Bitcoin was planned on account of one money related objective principal: maintaining a strategic distance from the terrible destiny of past financial structures by keeping the shades of malice of degradation.

Instead of trust in some removed, unaccountable human expert's astuteness and restriction, Bitcoin's supply cutoff is cherished in its code; its "computerized DNA," as an issue of consistent agreement.

Dissimilar to fiat cash, Bitcoin's esteem is additionally sponsored by substantial, quantifiable assets: code running on registering equipment fueled by power.

Given cash's (over-)significance to our current world, keeping up an innovatively better option than imperfect fiat monetary forms is unquestionably beneficial.

2. Mining Is Promising And Profitable

To have a good kick start in the world of Bitcoin mining, one should be aware on electrical cost to be low in order to compete head to head with other miners. This is the basic principle of mining and there are lots of ways to implement it. Another thing is a full knowledge with ASIC technology on mining hardware and excellent knowledgeable in both Bitcoin and the business.

Sharp specialists just need apply for this "permit to print cash."

Mining has a tendency to be moved in China because of a few local points of interest; China delivers a large portion of the world's ASIC equipment and has a few areas which over-put resources into power era.

Miners in any cool locale, which is associated with modest geothermal or hydro-electric power, have a comparative favorable position.

Be that as it may, it's assessed that no less than half of mineworkers are Chinese. This short narrative investigates the internal workings of a Chinese mining operation.

Mining is a developing industry which gives business, for the individuals who run the machines as well as the individuals who fabricate them. Given the lazy worldwide economy, new and promising enterprises ought to be commended!

3. Bitcoin Prevents Inflation

As insinuated in Reason 1, numerous rulers are weakening the estimation of "their" national monetary standards, either as a financial boost (for the most part to the total assets of elites) or as a way to ruin their huge obligation.

Such corruption rebuffs savers specifically, as the estimation of their put away riches is dissolved. Savers normally look to secure their fiat reserve funds by making an interpretation of them to a more sturdy shape, for example, outside cash or ventures.

Rulers frequently obstruct their natives' flight to money related wellbeing by forcing capital controls. China is known for its especially strict constraints.

Bitcoin mining speaks to a superb, legitimate approach to go around such limitations.

Putting resources into a mining operation brings a constant flow of bitcoins; a type of cash to a great extent outside the ability to control of the decision class.

For those working under prohibitive capital controls, mining accordingly speaks to a fantastic if unpredictable arrangement.

Given the relative expenses and dangers of other riches conservation measures, it might even be beneficial to mine Bitcoin at a misfortune!

Bloomberg gauges that one trillion remaining China in the year 2015, seven times more than was with in past year 2014! A considerable measure of that cash streamed into land buys in Western urban areas, (for example, Vancouver). </p>

This wonder has made limited air pockets and excessively expensive lodging conditions for occupants. The conceivable result is a terrible crash which sets the local economy back by years. By difference, Bitcoin mining speaks to a viable intends to protect riches without making such undesirable and unsafe market twists. In the event that we take Motherboard's direct extrapolation that Bitcoin will devour as much power as Denmark by 2020, then include the presumption that Bitcoin will have scaled adequately by then to take into account each client of the fiat framework… it winds up plainly conceivable to think about the two frameworks, in an as a matter of fact harsh and-prepared design. 4. Bitcoin Ultimate Versus Fiat System

Permitting that Bitcoin will supplant banks, ATMs, merchants, trades and installment administrations (like VISA, MasterCard and PayPal) around the globe, we can balance the power required by every one of those administrations.

Considering the joined electric expenses for these operations (covering lighting, aerating and cooling, server farms, site facilitating, office hardware and that's only the tip of the iceberg) the aggregate most likely methodologies or even surpasses Denmark's present power use.

Other than crude power, there are numerous different assets important to the proceeded with operation of the fiat framework however not to Bitcoin. For instance:

a. office things and paper printer

b. cash being transported by armored vehicles

c. ink, textiles and paper as well as the need of power for money making

d. fuel being used by employees to come and forth everyday

e. the rent and cost of resources in the office building

f. soon and so forth

5. Mining Generates Heat

As said under Reason 2, mining in a cool atmosphere is worthwhile as the mining procedure produces a lot of waste warmth. Be that as it may, ambitious Bitcoin excavators can catch and utilize this warmth beneficially!

There are numerous cases of server farms re-utilizing heat (for instance, IBM Switzerland warming an open swimming pool) which Bitcoin diggers could take after. Squander warmth can even be valuable to aquaculture and it's additionally conceivable to saddle hot fumes air for drying forms.

With respect to office or home utilize, an extra wellspring of aloof Bitcoin salary may serve to make comfortable indoor temperatures a more reasonable suggestion.

Despite the fact that gas, wood, oil and propane remain the less expensive warming alternatives, power tends to be the most advantageous. The uplifting news is that, as per the (to some degree out-dated) computations of a New York-based excavator, mining rigs offer impressive cost reserve funds over standard electric radiators.

As an extra advantage, mining apparatuses might be decisively controlled by means of basic processing equipment, to such an extent that a tweaked warming timetable or versatile atmosphere control framework might be modified without any difficulty.

The main drawback for home excavators is that mining apparatuses are regularly uproarious and un-anaesthetically-satisfying gadgets. Thus, they have a tendency to be sequestered in the storm cellar or carport for household concordance. A little creativity might be called for to pipe their warmth to where it's more required in the house.

Different organizations are joining Bitcoin mining and warming into shrewd gadgets, to the regale of both enterprises.

6. Bitcoin Mining Supports IoT

Proceeding with the topic of Bitcoin mix with family unit and modern gadgets, this is the exact plan of action of possibly troublesome Bitcoin organization, 21.co.

Twenty-one brought USD120 million up in funding, a record for a Bitcoin organization. As their underlying item offering, 21.co discharged a Raspberry Pi-like gadget with implicit Bitcoin highlights; mining included.

While such low-fueled mining gadgets acquire next to no pay, even a couple of hundred Satoshis opens the way to computerized small scale installments…

It's for quite some time been realized that Bitcoin offers genuine potential for machine-to-machine installments. This potential is probably going to be acknowledged soon™ with the organization of the principal Lightning Network.

The outcomes will undoubtedly be intriguing; maybe even the start of a significant mechanical move by they way we lead our lives and business!

Keen, interconnected gadgets offer awesome guarantee as far as self-detailing of issues and supply deficiencies, even the self-alignment and the self-determination of issues. Bitcoin and extra layers are the no doubt installment roads to provide food for these new, creating enterprises.

All things considered, machines don't have financial balances or Visas. By what other means will machines pay for their own particular sources of info and how better would they be able to charge for their yields?

Positively the possibily of empowering such energizing and conceivably transformative advancements is justified regardless of the vitality cost… especially given the collaboration between keen gadgets and power sparing through expanded proficiency.

7. Struggles of Germany And Denmark In Excess Of Power

It was as of late detailed that Germany's sunlight based and wind era about over-burden its electric network over an especially sunny and blustery day. Control organizations paid their clients to utilize more power so that the vitality could be securely scattered.

Fairly unexpectedly, considering Motherboard's correlation, comparative abundance control circumstances are known to happen in adjacent Denmark.

This implies on the off chance that you set up in an area which encounters power oversupply from variable green sources, it's conceivable to get paid for mining Bitcoin as an open administration!

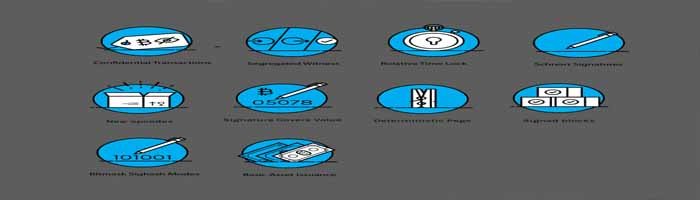

8. Bitcoin Is Not Just All About Mining

On the off chance that the mining procedure is the capable motor driving Bitcoin, then it's absolutely an interesting motor in that it loses no productivity for driving extra procedures.

Namecoin, the primary altcoin, utilizes the same SHA-256 Proof of Work calculation as Bitcoin, which implies mineworkers any discover answers for both Bitcoin and Namecoin pieces simultaneously. As Namecoin serves a decentralized DNS (Domain Name Server), the impact is to convey more prominent flexibility and oversight imperviousness to the web.

Fairly like Namecoin in idea, yet more firmly attached to Bitcoin, are side-chains. These are basically separate blockchains which are pegged to Bitcoin's blockchain. This advantages Bitcoin by stretching out it to generally unserviceable utilize cases.

It additionally benefits the side-chain by sponsorship and securing it cryptographically with the enormous energy of the Bitcoin mining industry.

Tokenized coins are another innovation layer with expansive ramifications, which are comparatively upheld and secured by Bitcoin mining.

By partner specific units of bitcoin with computerized, money related or physical resources, responsibility for resources might be traded. This works including stocks to in-amusement things to land deeds et cetera.

Different securities exchanges, arrive registries and patient databases around the globe are exploring different avenues regarding such applications. Counterparty is a case of a Bitcoin-based stage which empowers tokenization, as broadly (?) found in the Rare Pepe Directory.

9. Constant Increase Of Mining Efficiency

At long last, it must be noticed that proficiency of Bitcoin mining is continually enhancing, so less power is utilized to give more cryptographic security.

Since Bitcoin's discharge in 2009, mining equipment has advanced from PC CPUs to realistic card GPUs to FPGAs (Field-Programmable Gate Array) and now to ASICs (Application-particular Integrated Circuit).

ASIC mining chip architecutre and procedures are under ceaseless advancement, with lucrative rewards on offer to the individuals who put up the most recent and most prominent developments for sale to the public.