What is the Bitcoin Mining Block Reward?

The Bitcoin block reward refers to the new bitcoins distributed by the network to miners for each successfully solved block.

How is the Block Reward Determined?

Satoshi Nakamoto, Bitcoin’s creator, set the block reward schedule when he created Bitcoin. It is one of Bitcoin’s central rules and cannot be changed without agreement between the entire Bitcoin network.

The block reward started at 50 BTC in block #1 and halves every 210,000 blocks. This means every block up until block #210,000 rewards 50 BTC, while block 210,001 rewards 25. Since blocks are mined on average every 10 minutes, 144 blocks are mined per day on average. At 144 blocks per day, 210,000 blocks take on average four years to mine.

Total circulation will be 21,000,000 coins. It’ll be distributed to network nodes when they make blocks, with the amount cut in half every 4 years. first 4 years: 10,500,000 coins next 4 years: 5,250,000 coins next 4 years: 2,625,000 coins next 4 years: 1,312,500 coins etc… - Satoshi Nakamoto

Importance of the Block Reward

The block reward is the only way that new bitcoins are created on the network. Satoshi explained this in an early email post in 2009:

Coins have to get initially distributed somehow, and a constant rate seems like the best formula.

The block reward creates an incentive for miners to add hash power to the network. The block reward is what miners try to get using their ASICs, which make up the entirety of the Bitcoin network hash rate.

ASICs are expensive, and have high electricity costs. Miners are profitable when their hardware and electricity costs to mine one bitcoin are lower than the price of one bitcoin. This means miners can mine bitcoins and sell them for a profit.

The more hash power a miner or mining pool has, the greater the chance is that the miner or pool has to mine a block. As miners add more hash rate, more security is provided to the network. The block reward acts as a subsidy and incentive for miners until transaction fees can pay the miners enough money to secure the network.

What Happens when the Block Reward Becomes Small?

As mentioned earlier, Bitcoin users must pay a fee when sending a transaction on the network. Right now, these fees are small since there aren’t many Bitcoin users. Eventually, these transactions fees will become larger and will help make up for the decreasing block reward.

In a few decades when the reward gets too small, the transaction fee will become the main compensation for nodes. I’m sure that in 20 years there will either be very large transaction volume or no volume. - Satoshi Nakamoto

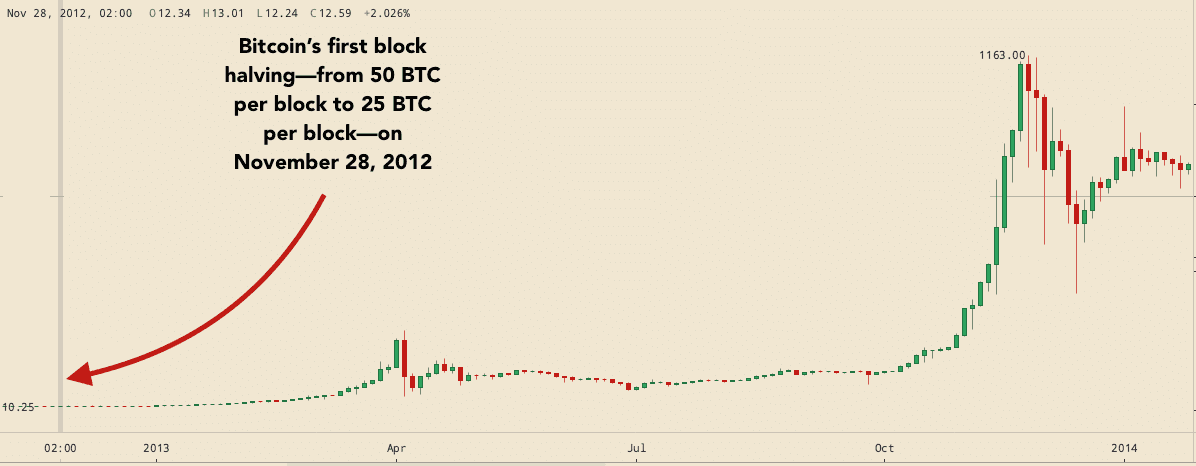

Do Reward Halvings Affect the Bitcoin Price?

It is impossible to determine whether or not block reward halvings affect Bitcoin’s price.

As with any commodity, a decrease in supply paired with no change in demand generally leads to higher price. Bitcoin is unique, however, since the block reward schedule is public. All Bitcoin users and miners know the approximate date of each halving, meaning the Bitcoin price may not be affected when the halving happens.

Bitcoin’s first block halving happened on November 28, 2012. The block reward dropped from 50 bitcoins per block to 25 per block. The price later climbed to $260 per BTC in April 2013, followed by $1,163 per BTC in November 2013. It is unclear, however, whether these price rises were directly related to the block reward halving.

How do Block Reward Halvings Affect Miners?

Block reward halvings cut miners’ earnings in half, assuming the same Bitcoin price before and after the halving. Since approximate block halving dates are known, most miners take block reward halvings into account before they happen.

Block reward halvings also decrease supply, which as discussed above may cause Bitcoin’s price to increase. A Bitcoin price increase can help offset the block reward halving.

Future Block Reward Halvings

Countdowns like Bitcoin Block Half and Bitcoin Clock can be used to guess future block halving dates.

Block Reward History

| Date reached | Block | BTC/block | Year (estimate) | BTC Added | End % of Limit |

|---|---|---|---|---|---|

| 1/3/09 | 0 | 50 | 2009 | 2625000 | 12.50% |

| 4/22/10 | 52500 | 50 | 2010 | 2625000 | 25.00% |

| 1/28/11 | 105000 | 50 | 2011 | 2625000 | 37.50% |

| 12/14/11 | 157500 | 50 | 2012 | 2625000 | 50.00% |

| 11/28/12 | 210000 | 25 | 2013 | 1312500 | 56.25% |

| 10/9/13 | 262500 | 25 | 2014 | 1312500 | 62.50% |

| 8/11/14 | 315000 | 25 | 2015 | 1312500 | 68.75% |

| 7/29/15 | 367500 | 25 | 2016 | 1312500 | 75.00% |

| 420000 | 12.5 | 2017 | 656250 | 78.13% | |

| 472500 | 12.5 | 2018 | 656250 | 81.25% | |

| 525000 | 12.5 | 2019 | 656250 | 84.38% | |

| 577500 | 12.5 | 2020 | 656250 | 87.50% | |

| 630000 | 6.25 | 2021 | 328125 | 89.06% | |

| 682500 | 6.25 | 2022 | 328125 | 90.63% | |

| 735000 | 6.25 | 2023 | 328125 | 92.19% | |

| 787500 | 6.25 | 2024 | 328125 | 93.75% |